Medicare Part D Annual Enrollment Period

By the GWAAR Legal Services Team

Each year from October 15 through December 7, there is an Annual Enrollment Period (AEP), also known as the Open Enrollment Period, for Medicare Beneficiaries to change their Part C and/or Part D plans.

During the AEP, a person can make any of the following changes:

- Join a Part D plan (if not already enrolled);

- Drop a Part D plan;

- Switch to a new Part D plan;

- Drop a Medicare Advantage plan and return to Original Medicare;

- Join a Medicare Advantage plan with or without drug coverage.

Changes made during the AEP will be effective on January 1, 2017. Even if Medicare beneficiaries are happy with their current Part D plan, they should still re-evaluate that drug plan to determine if it will best meet their needs for 2017. Because Part C and Part D plans are privatized, they are allowed to change the terms of coverage every year. New Part D plans become available, and some Part D plans stop offering coverage in the state. Even if a plan continues to offer coverage for the following year, its monthly premium, formulary, pharmacy network, deductible, and copay amounts could all change! It’s important that Medicare beneficiaries review their Annual Notice of Change (ANOC), which arrives in the mail on or before September 30th. This document notifies Medicare beneficiaries of the changes to their Part D plan that become effective January 1, 2017.

The most effective way to choose a Part D plan is by going on the www.medicare.gov website and using the “planfinder” tool. The planfinder asks a person to enter his or her zip code, prescription medications, and preferred pharmacies. Based on this information, the planfinder will list the plans that would be most cost effective for that person.

Unfortunately, research shows that fewer than 10% of Medicare beneficiaries are enrolled in the most cost-effective Part D plan. Name recognition or looking at a plan’s monthly premium alone are not good ways to choose a plan. If a person is unsure how to pick and evaluate a plan, the person can utilize the following resources:

- Local benefit specialist.

- Case manager or social worker.

- Board on Aging and Long-Term Care Part D helpline (ages 60+) at (855) 677-2783.

- Board on Aging and Long-Term Care Medigap helpline at (800) 242-1060.

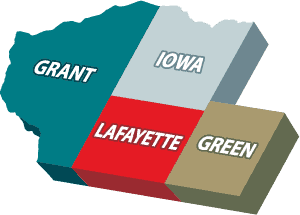

- Disability Rights Wisconsin Part D helpline (ages 18-59) at 800-926-4862.